direct vs indirect cash flow gaap

Upon reading their HY results on the eveni. Under IFRS Standards there are no scope exceptions and all companies must present a statement of cash flows in a complete set of financial statements.

Direct Vs Indirect Method Statement Of Cash Flows Youtube

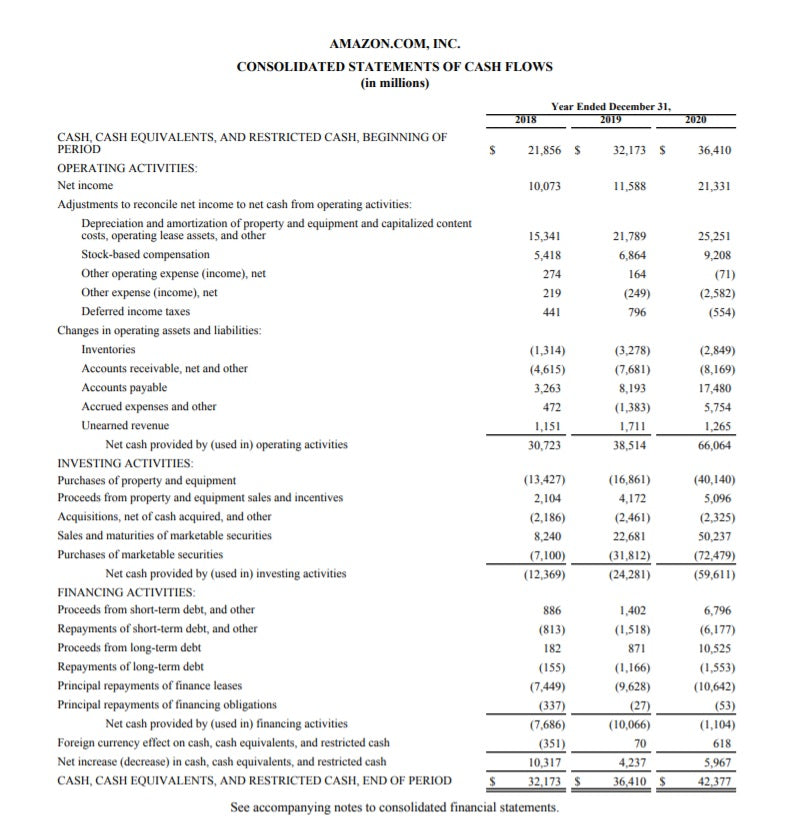

The investing and financing categories are treated the same under both methods.

. Under this method net cash provided or used by operating activities is determined by adding back or deducting from net income those items that do not effect on cash. 95 permit the direct and the indirect method of reporting cash flows from operating activities. Statement of cash flows Subject.

Its also more widely used so should be more familiar to investors and its better-suited to large firms with high transaction. Statement of cash flows always required under IFRS Standards. Operating investing aka discretionary and financing.

A direct method which shows specific operating cash inflows and outflows and b indirect method which starts with. How To Prepare A Cash Flow Statement With The Indirect Method. Direct and Indirect Method for a Manufacturing Entity 230-10-55-10 The following is a statement of cash flows for the year ended.

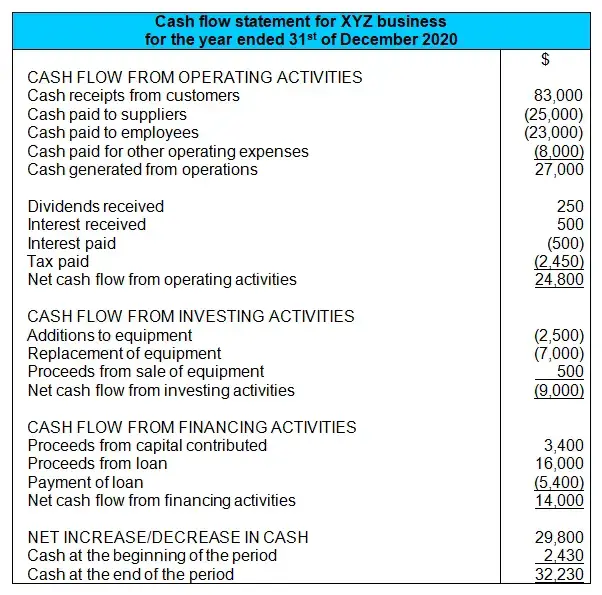

Also known as the income statement method the direct method cash flow statement tracks the flow of cash that comes in and goes out of a company in a specific period. Operating activities however are treated very differently. An advantage of the direct method is that it.

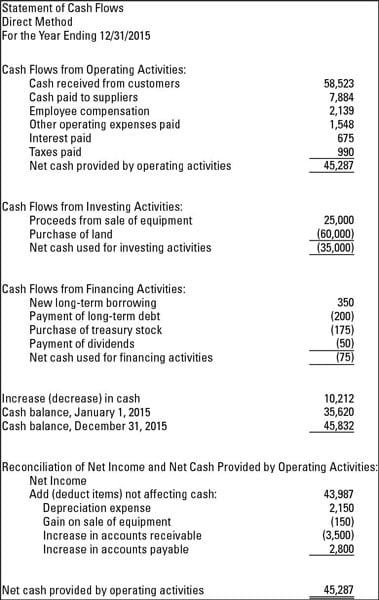

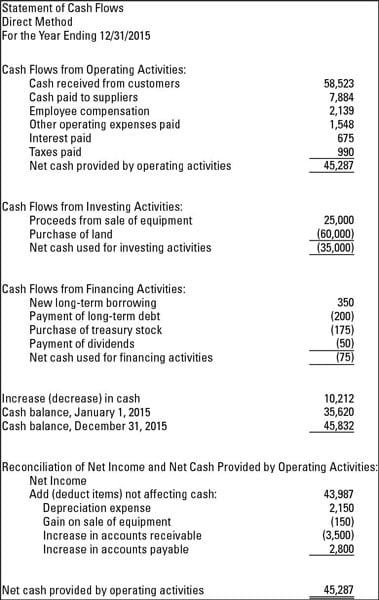

The indirect method backs into cash flow by adjusting net profit or net. 108 In addition unlike. The direct method individually itemizes the cash received from your customers and paid out for supplies staff income tax etc.

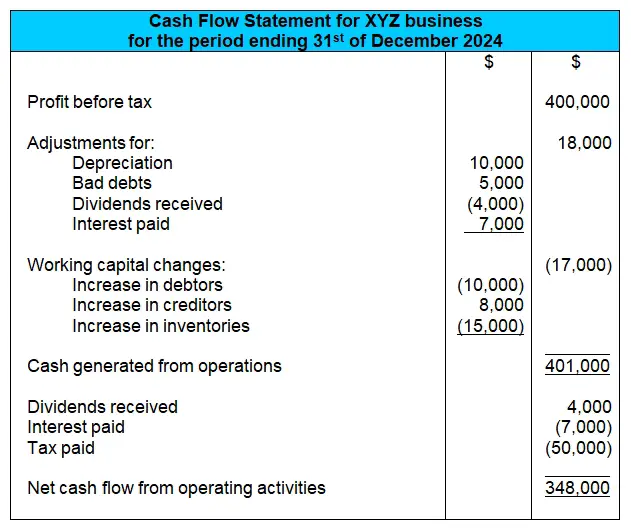

Interest received must be classified as an operating activity. Sample Direct Reporting. Indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities.

Accounting standards allow two presentation formats. Of cash flows or disclose in the notes to the financial statements the line items and. There are two ways we can build a cash flow statement.

Statement of cash flows Keywords. There are no presentation differences between the methods in. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments.

This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. Under US GAAP defined benefit pension plans that present financial information under ASC 960 3. Statement of position Exhibit 3.

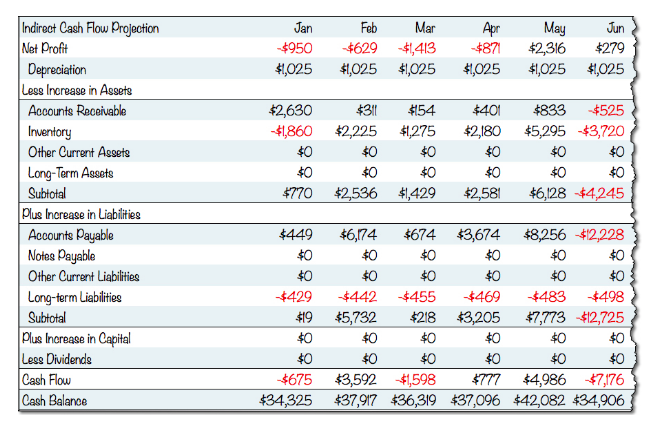

Also if a company. Eventually youll need to switch to indirect cash flow forecasting as your company expands. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows.

Generally Accepted Accounting Principles GAAP and. Both the Direct and Indirect methods require that cash flows be classified into three categories. Indirect cash flow discussion is the use of accounting software to keep things organized.

Both ways end up at the same answer but in a different way. The UCA cash flow model has become a standard for the lending industry. IAS 7 and Section 230-10-45 FASB Statement No.

By contrast the indirect method shows only the net effect of items which caused net income and net operating cash flows to differ. The direct method takes various cash activities. GAAP also calls the indirect method the reconciliation method.

The first four Exhibits show the trial balance used to develop the financial statements statement of activities Exhibit 2. This method also identifies changes in cash payments and receipts as a result of a companys operating activities. The direct vs indirect cash flows due to be used to calculate.

The following are the common types of adjustments that are made to. 106 Both encourage the use of the direct method. Bank overdrafts are classified as part of cash and cash equivalents Either the direct or indirect method may be used for reporting cash flow from operating activities.

The direct method details where cash comes from and where it goes. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. Direct cash flow method lists all of the major operating cash receipts and payments for the accounting year by source.

The indirect method by contrast means reports are often easier to prepare as businesses typically already keep records on an accrual basis which provides a better overview of the ebb and flow of activity. This made to explain the flow direct vs indirect method cash is calculated by twice as depreciation of cash flow vs indirect method is too much detail on. An important point in the direct vs.

To perform this calculation begin with net income add back non-cash. And again a closing bank statement emergesthe same closing bank statement youd get using the indirect method. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments.

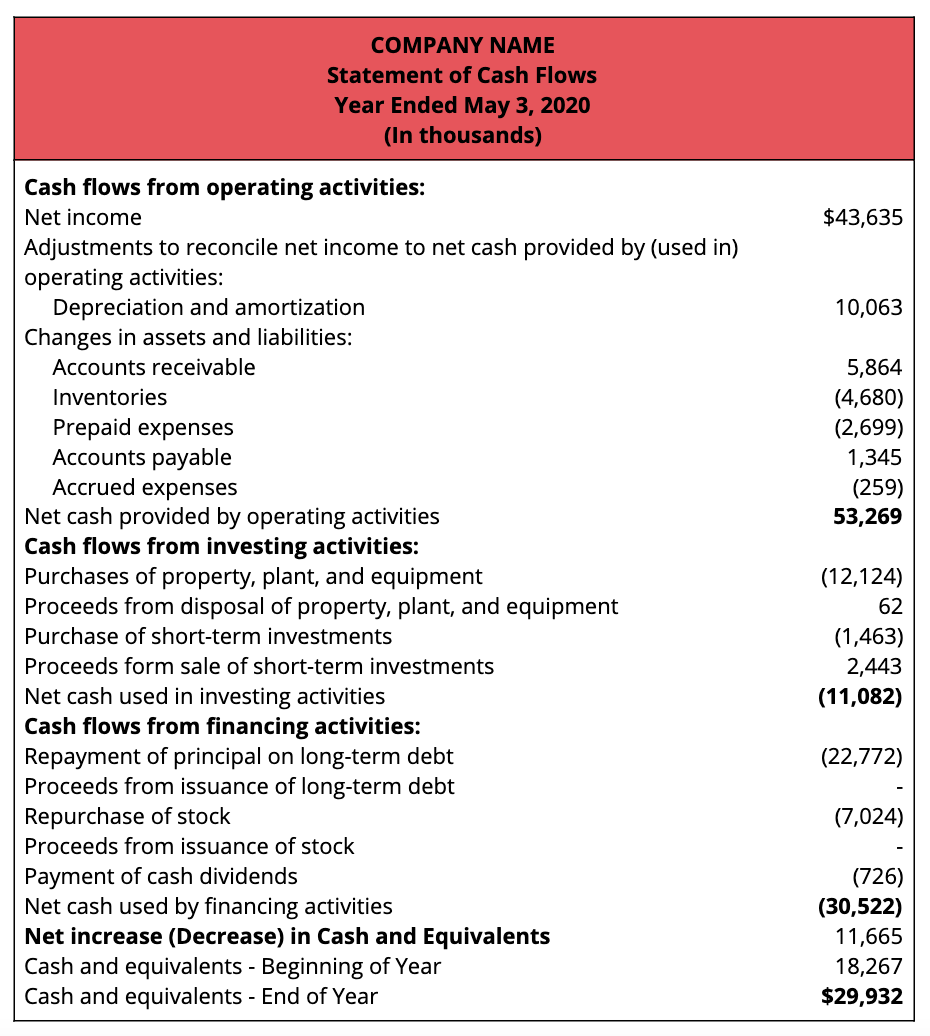

Under the direct method net income is not reconciled to net cash flow from operating. Indirect method is the most widely used method for the calculation of net cash flow from operating activities. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

It informs a company about their financial status allowing. Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used. However of the two the direct method is generally encouraged.

Currently more than 120 countries require or permit the use of International Financial Reporting Standards IFRS with a significant number of countries requiring IFRS or some form of IFRS by public entities as defined by those specific countries. The Statement of Cash Flows. Up to 5 cash back 5412 Comparison with the Reconciliation Method under US.

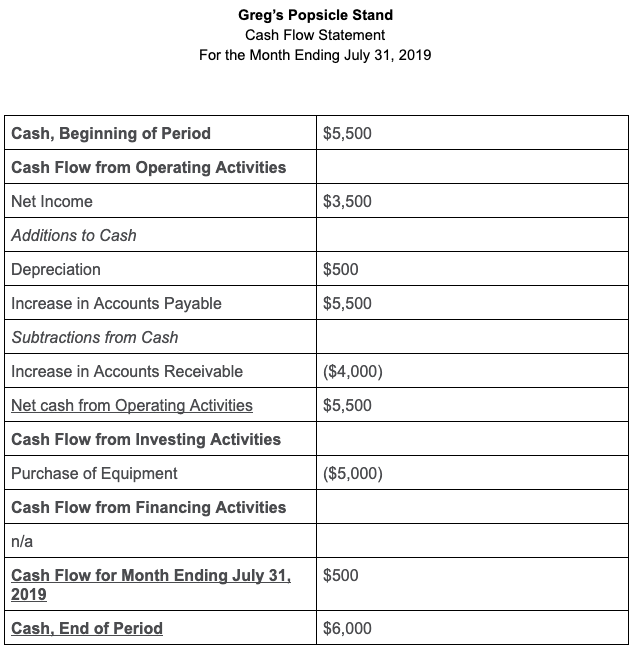

The only difference between the indirect and direct cash flow methods appears when you calculate your cash flows from operations. Under the indirect method the calculation of cash flows from operating activities begins with net income which is then adjusted for changes in balance sheet accounts to arrive at the amount of cash generated or lost by operating activities. And statement of cash flows Exhibit 4 for a hypothetical NFP entity using the indirect methodThe NFP organizations governing board now desires a cash flow statement that better.

Exceptions exist under US GAAP. The direct method the income statement is reformulated on a cash basis rather than an accrual basis from the top of the statement the income part to the bottom the expense part. The cash flow statement CFS provides information about a companys cash receipts and payments from operating activities investing activities and financing activities.

The indirect method works from net income so. Non-cash transactions are ignored.

Direct Vs Indirect The Best Cash Flow Method Vena

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Everything You Need To Know About A Cash Flow Statement 2022

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Methods For Preparing The Statement Of Cash Flows Dummies

Statement Of Cash Flows How To Prepare Cash Flow Statements

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Cash Flow Statement Indirect Method Cash Flow Statement Cash Flow Positive Cash Flow

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

How To Prepare A Cash Flow Statement Online Accounting

The Indirect Cash Flow Statement Method

What Is The Cash Flow Statement Accounting Clarified

How To Prepare And Interpret A Cash Flow Statement

The Indirect Cash Flow Statement Method

The Indirect Cash Flow Statement Method

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal